Customers always have so many options in the market to choose their desired product or service. But what about the business owners?

“Do they get the opportunity to choose as well?”

No, they obviously don’t. If anything, you have a specific target audience who finds your services relevant. Just in case they aren’t satisfied, they can opt for any of your competitors in the market. That pretty much sums up your story.

In short, your success relies on the fact that your customers don’t leave you.

And if you successfully increase customer retention rates by 5%, then you can boost profits by 25% to 95%.

That’s one of the reasons why you formulate strategies to retain your customers. But without numbers or metric data in hand, coming up with any new strategy would only consume your valuable time.

For example, you need access to metrics like NPS, average response time and others like it to make sure you come up with relevant strategies that help you retain more customers. In one of the surveys too, 47% of business owners find customer satisfaction to be one of the most important metrics to measure success.

Keeping that in mind, we’ve decided to help you learn the different metrics that would allow you to create effective strategies that not only gives you an edge in the market but also retain your existing customers.

So, buckle up. In this thorough guide, you’ll come across:

- Different SaaS customer success metrics

- How to calculate metrics to measure customer success properly

- How to improve the metrics for measuring customer success

The Essential Metrics for Measuring Customer Success

With customers having all the power, it becomes challenging for you to make them stay.

You try your best not to make any mistakes. But rather than trying to do that, how about you measure customer success using customer support tool metrics to understand their thought process better.

In this section, we plan to do just that. You’ll get to know about a few metrics that can help you measure customer success effectively.

#1: Customer Churn Rate

#2: Monthly Recurring Revenue Rate

#3: Expansion MRR Rate

#4: Net Promoter Score (NPS)

#5: Customer Satisfaction Score

#6: Customer Lifetime Value (LTV)

#7: LTV/CAC Ratio

#8: Average Revenue Per Account

#9: Customer Retention Rate (Over Time)

#10: Customer Retention Cost

#11: Customer Health Score

#12: First Contact Resolution Rate

#13: Renewal Rate

#14: First Response Time

#15: Daily Product Usage

And we’ll not stop there.

Rather than just explaining the concept, we’ve also made sure that you get to learn how you can measure each metric and various strategies to help you improve them.

So, let’s get started!

#1: Customer Churn Rate

Customer Churn Rate (CRR) is considered one of the most important customer support metrics as it helps figure out the percentage of customers that have given up on using your product or service. And by giving up, we mean closed accounts, stopped renewing services, canceled subscriptions, or did whatever it takes for them to be considered inactive.

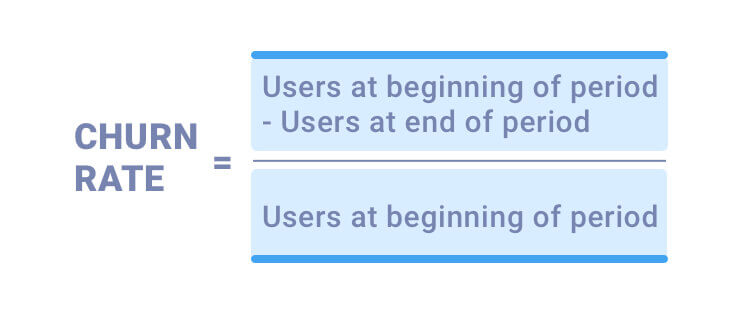

How to Measure Customer Churn Rate?

Luckily, CRR calculation is a pretty effortless process. The only thing you should do before the calculation is to determine the period for which you want to analyze the rate.

Then, divide the number of customers that you lost in that period by the number of customers that started using your products or services. Finally, to get a relevant percentage, multiply it by 100.

Customer Churn Rate Formula:

How to Improve Customer Churn Rate?

There are several recommendations that you should have in mind if you want to handle this metric properly:

1. Provide the highest possible value of your product/service and impeccable user experience.

Try to come up with attractive ways to keep the customers engaged, satisfied, and interested in your content. Besides, you can always try to make them stay loyal to your products by offering some loyalty incentives.

2. Figure out the reason they decide to leave.

Pay attention to everything that they tell you in surveys and support sessions. This way, you may be able to realize what makes them give up and address this issue to reduce your CCR.

3. Fix a problematic churn rate using expansion revenue.

In other words, make up for lost customers by growing revenue from your existing customers. This type of compensation is also known as ’negative churn’, and it can help you somewhat overcome the issues caused by high CRR.

4. Reduce CRR’s impact on your performance by increasing customer acquisition.

Although this strategy doesn’t really improve your CRR, it definitely can help neutralize its adverse effects on your business performance in the short run. While you shouldn’t rely on this way of dealing with CRR all the time, it can be helpful if you get stuck and want to buy some time.

#2: Monthly Recurring Revenue Rate

Monthly Recurring Revenue Rate (MRR) is a customer success metric that helps you keep track of monthly revenue and spot the oscillations in them in different periods. Measuring the expected revenue, MRR is highly important both when you’re making financial predictions and planning, and when you’re trying to measure the monthly growth of your business.

How to Measure Monthly Recurring Revenue Rate?

MRR is one of the customer success KPIs that may seem troublesome to calculate. However, if you consider it a series of simple tasks, the process may become more comfortable to handle. Here’s what you should do:

- Create a spreadsheet with all your customers from the period you’ve chosen to analyze. This document should consist of two columns. The first column is supposed to include each customer’s account ID. The second one is for their monthly subscription value.

- To get the monthly subscription value, you should divide each customer’s contract value by the number of months included in their contract.

- Calculate the total MRR by summing up all of the subscription values in your document.

- (Optional) If you want to get more specific data, you can do the data break down by different filters, such as a pricing plan or other criteria relevant for your analysis. The process of calculation is the same; all you have to do is only consider the filters you’re interested in.

Monthly Recurring Revenue Rate Formula:

How to Improve Monthly Recurring Revenue Rate?

If you want to have an accurate recurring revenue calculation and a growing MRR from month to month, pay attention to these two essential tips:

1. Have your MRR properly calculated.

Note that this is only possible if you base the calculation on the relevant data. Some of the most common miscalculations appear when businesses include the full value of their contracts into a one-month calculation.

Also, some businesses tend to subtract transaction fees from MRR, which usually leads to misleading results. Finally, don’t include your customers’ one time payments into this calculation as these obviously don’t represent your recurring revenue.

2. Don’t underprice your products or services.

While it may seem risky for you to increase the price of your products, the truth is that businesses sometimes give too much value for not so much money.

Now, note that we’re not speaking of skyrocketing your prices. Rather than that, all you have to do is put them in balance with the value you provide. The fear of rejection may cost you a lot of underestimation, frustrations, and losses, so try not to be too self-conscious and build a realistic price.

For instance, to facilitate the growth of revenue, such as recurring revenue, you can introduce a pay-per-user pricing model. This way, as your customers’ businesses or communities grow, your recurring revenue will grow as well, as they will keep buying your products or services for their new employees.

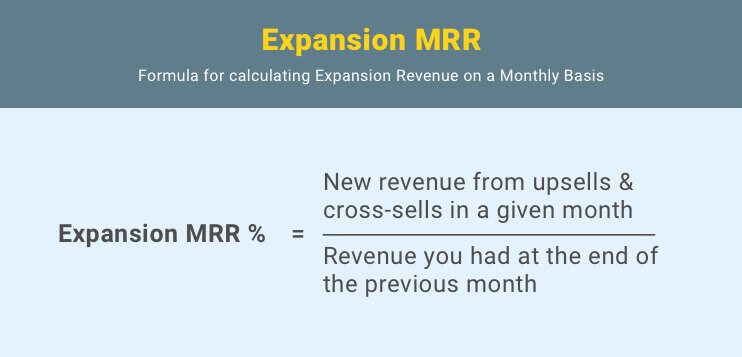

#3: Expansion MRR Rate

Expansion MRR Rate is a helpful customer success metric as it represents the monthly value of the new revenue collected from your existing customers’ additional purchases. And this additional revenue may come from a diversity of sources. Upsells, cross-sells, and advanced features/plugins/add-ons that they don’t get with their standard subscriptions are only some of these sources.

How to Measure Expansion MRR Rate?

To keep track of your monthly Expansion MRR, all you have to do is add the additional revenue collected from your current customers in a specific month. Now, how to transform these values into a percentage rate? Here’s what you should do:

- Subtract Expansion MRR at the beginning of the month from the Expansion MRR at the end of the month.

- Divide the obtained value by the Expansion MRR at the beginning of the month.

- Multiply the result by 100 to make it into an exact percentage.

Expansion MRR Rate Formula:

How to Improve the Expansion MRR Rate?

Even though you may read about a diversity of strategies for Expansion MRR improvement, all of them are essentially included in the following two tips:

1. Provide additional value that will inspire additional purchases.

Practically speaking, the more problems your products or services can address, the greater chances you have to make your customers make additional purchases. So, make sure to pay attention to your customers’ troubles and needs and offer them upgrades, add-ons, and special packages that they won’t be able to resist.

2. Increase your chances to upsell.

In other words, make your additional products, upgrades, and higher subscription plans more visible to your customers. And when we say ’more visible’, we don’t only refer to highlighting them on your website. We’re also speaking of improving their general marketing, talking about their advantages, emphasizing the outcomes they provide, etc.

#4: Net Promoter Score (NPS)

There is a large set of customer success metrics that analyze customer experience, and Net Promoter Score (NPS) is among the most useful ones. Based on the use of simple surveys, this metric can easily show you how loyal your customers are to your brand. On the one hand, NPS helps you discover how likely your customers are to spread the word about your brand. On the other hand, it can also signal some weak points in their experience, and you can try to improve them.

How to Measure Net Promoter Score?

This metric definitely owes a part of its popularity to the fact it’s extremely easy to measure and analyze. Here’s what you should do to calculate your Net Promoter Score.

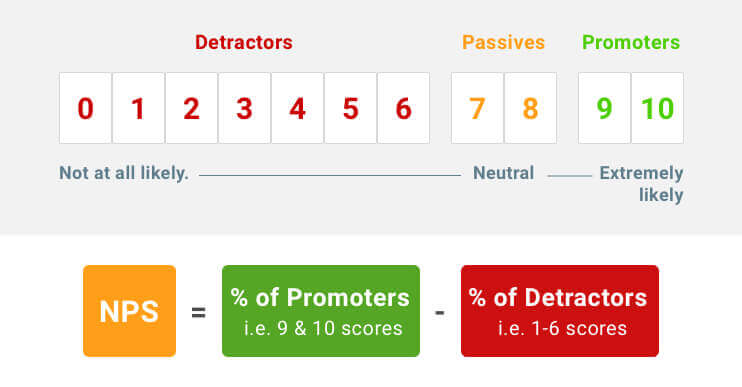

First, you have to create a survey with a straightforward question, which is:

How likely are you to recommend our brand to your family, friends, or colleagues on a scale from 0 to 10?

Then, based on the customers’ feedback, you should classify them into three groups:

- Detractors – those that gave you a score lower than 7

- Passives – those that gave you 7 or 8

- Promoters – those that gave you 9 or 10

Finally, to obtain your NPS, you should follow a simple formula:

Accordingly, the higher the rate of your NPS is, the better chances you have of promoting your brand by word of mouth.

Read More: How to Calculate Net Promoter Score [EXPLAINED]

How to Improve Net Promoter Score?

Now, if you want to improve your Net Promoter Score in the long run, you should base the improvement on some well-thought actions and consistent plans. Here’s what you may consider:

- Collecting customers’ feedback strategically, using a diversity of methods which will help deepen the knowledge on their experience, including interviews, emails, follow-up emails, etc.

- Making your staff members understand the importance of NPS and increasing the number of promoters. Organize frequent meetings to discuss this topic, compare results, and introduce new ways of improving customer experience.

- Seriously dealing with your customers’ feedback, referring to your employees’ skills and professionalism. Use it to create training that will help take your relevant departments to a higher level.

- Trying to get to the roots of a low NPS, and focusing on the improvement of the critical departments whose actions brought poor results. You can easily figure out where the problem is if you add an open-end question to your survey, asking about the reasons for a low score.

- Testing different structural changes and choosing the ones that have the best impact on your NPS.

#5: Customer Satisfaction Score

Customer Satisfaction Score (CSAT) has an important place among the SaaS customer success metrics. Like its name says, this metric helps you figure out how satisfied your customers are with your brand. It’s another one of the customer success KPIs that collect data using a survey.

How to Measure Customer Satisfaction Score?

The most important thing when measuring CSS is the customers’ answer to a variation of the question:

How satisfied are you with the purchased product or service on a scale of 1-5?

Now, this scale should be organized in the following way:

1 – not satisfied at all

2 – somewhat unsatisfied

3 – indifferent

4 – somewhat satisfied

5 – very satisfied

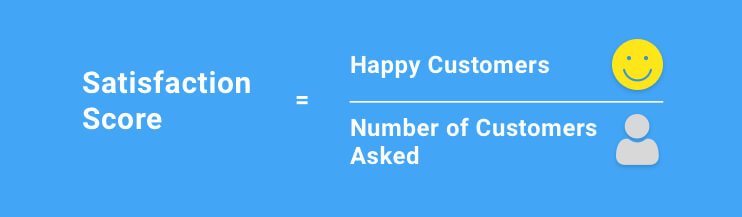

Once the results are collected, all you should do is:

- divide the number of satisfied customers (4 and 5) by the number of survey responses

- multiply the obtained number by 100 to convert it into the percentage of the satisfied customers

Customer Satisfaction Score Formula:

Read More: How to Measure Customer Satisfaction Score [EXPLAINED]

How to Improve Customer Satisfaction Score?

Probably the best answer to this question is to focus on your customers, not on your score. Only if your whole organization is completely into your customer experience, trying to figure out how customers feel about different aspects of your brand, you can expect major improvements. This way of doing business is also known as customer-centric business culture, and here’s what you can do to make sure you’re on the right path:

1. Pay attention to your employees.

To be able to create an amazing customer experience, your employees should be motivated as well. Provide them with tools, processes, and training that they need to be able to please customers. Engage them, teach them about the importance of customer experience, and make them feel important in your mission.

2. Make it convenient for customers to provide their feedback.

The majority of business has stopped relying on phone calls and live questionnaires. Today, the impeccable feedback collection usually includes the use of survey makers and flawless question formulations. These surveys should be easy to fill, not take too much time, and be positioned in a visible place on your website so that customers can access them effortlessly.

3. Make the real use of the information received.

Surveying customers is not just about collecting feedback. Rather than that, it’s about getting reliable and trustworthy feedback, analyzing it, and transforming it into actionable tips that you should follow as much as possible to improve customer satisfaction.

#6: Customer Lifetime Value (LTV)

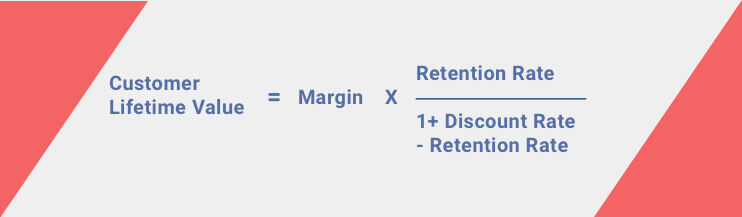

Customer Lifetime Value (LTV) is one of the exceptionally valuable SaaS customer success metrics when it comes to growing companies. Simply put, this metric helps you get the real insight into the revenue you can get from one customer account while it’s active. It is based on the comparison of the value of customer’s revenue and the predicted lifespan of that customer.

How to Measure Customer Lifetime Value?

Before you start the calculation, you have to define the period for which you’re measuring customer lifetime value. Now, having in mind that this process may be somewhat complicated if you have no experience measuring LTV, let’s go through the calculation step-by-step.

- Divide your total revenue for the chosen period by the number of purchases in that period to get the average purchase value.

- Divide the total purchase number by the number of unique customers in the chosen period to get the average purchase frequency rate.

- Multiply the average purchase value (the value from step 1) by the average purchase frequency rate (the value from step 2) to get the customer value.

- Average the number of years a customer keeps purchasing your products or services to get the average customer lifespan.

The final calculation of LTV:

Multiply customer value (the value from step 3) by the average customer lifespan (the value from step 4) to get a reasonable estimation of the revenue that you may expect from an average customer during their lifespan.

Customer Lifetime Value Formula:

How to Improve Customer Lifetime Value?

The two most important business aspects that you should focus on if you want to increase Customer Lifetime Value are customer satisfaction and retention.

Practically speaking, if your customers are satisfied with your products, services, and support system, they will be more likely to spend more on your brand during their relationship with you.

In addition, once you identify your most important customers (those that make a significant number of high-value purchases), you should do your best to nurture your relationship and keep them loyal, as this will directly impact your LTV.

Read More: Learn How to Maximize LTV for Your Business Here!

#7: LTV/CAC Ratio

If LTV has its place among your essential metrics for measuring customer success, then you should consider getting the most out of it by calculating LTV to CAC ratio. Putting customers’ lifetime value concerning customer acquisition costs, this metric lets you realize if your investment in customer acquisition is paying off.

How to Measure LTV to CAC Ratio?

First, you have to know your LTV and CAC values. And as we’ve already discussed LTV, let’s briefly explain the calculation of CAC. Simply put, the calculation of customer acquisition costs is based on dividing all the relevant marketing and sales costs by the number of acquired customers.

Once you get both values, all you have to do is divide your customer’s lifetime value with acquisition costs.

To be able to analyze this ratio properly, you should know that the ideal LTV to CAC ratio is 3:1.

So, practically, if your LTV is three times higher than your CAC, you’re doing business successfully. If your CAC is higher, you should analyze your business and try to handle the critical aspects causing this inefficiency. Also, if your LTV is more than three times higher than CAC, it may mean that you are missing out on chances to attract new customers.

How to Improve your LTV to CAC Ratio?

If you want to work on this crucial SaaS customer success metric, you’re probably aware that you have to work on both your LTV and your CAC. We’ve already suggested that improving customers’ lifetime value requires some hard work on customer satisfaction and customer retention.

So, now, let’s check some of the most reliable ways of increasing the efficiency of your customer acquisition costs:

- Improve your website design to increase conversions, including your landing pages, calls-to-action, mobile responsiveness, etc. To get the maximum conversions, you can use conversion rate optimization tools.

- Use the tactics that will make your products or services more appealing to attract new customers, such as upgrades, unique features, special offers, etc.

- Make use of customer relationship management software that will increase your process efficiencies and impact the reduction in the acquisition costs.

Once you start applying these recommendations on improving LTV and CAC, you will undoubtedly see major positive changes in your LTV to CAC ratio.

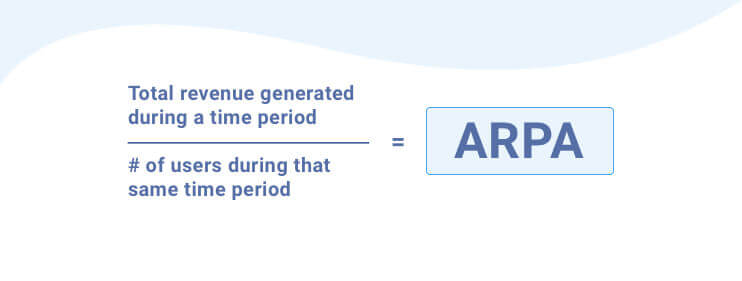

#8: Average Revenue Per Account

Like its name says, this customer success KPI represents the average monthly revenue that your business obtains per customer. It is an extremely valuable metric for SaaS companies as it helps them identify the trends of different user groups for varying periods. It also makes it possible for them to create relatable and reliable short-term and long-term plans.

So, it is highly useful when analyzing the financial health of your business, the value that you extract from your customers, and the quality of the sales driven by your marketing and sales teams.

How to Measure the Average Revenue Per Account?

Not only is ARPA one of the essential customer success metrics for SaaS businesses, but it’s also one of those that are calculated relatively easily. To measure it monthly, you should divide total MRR (whose calculation we’ve already explained) by the number of active customers.

Average Revenue Per Account Formula:

How to Improve Average Revenue Per Account?

To have your ARPA improved, you should definitely take into consideration every possible way of increasing revenue. The simplest way to make this happen is by creating a thorough and precise upgrade and add-on strategy. Of course, you should also try to reach the expansionary revenue by giving a value metric a central position in your pricing plan.

Besides, you should put some effort into working on customer retention, as the customers’ churn negatively affects your revenue, and, therefore, has a bad impact on this metric.

Finally, you should also make sure to be addressing the right profile of customers. Stop spending time and money on distractors, that is, on small and unaffordable customers that generate insignificant revenue, and focus on your highest value providers.

#9: Customer Retention Rate (Over Time)

Customer Retention Rate (CRR) makes an essential part of every reliable set of customer success metrics. And this is owed to the fact that it helps you quantify customers’ experience and their satisfaction with your brand. In other words, it shows you how successful your business is in terms of retaining customers.

Now, if you want to make it even more useful, you can also consider analyzing it over a longer period of time, for instance, for a month, two, or three after a specific customer has contacted your support staff.

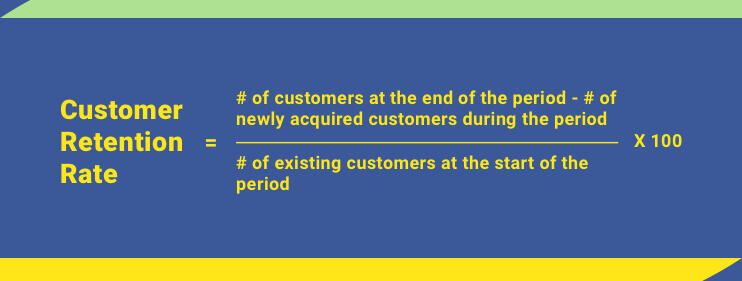

How to Measure Customer Retention Rate?

The purpose of this customer success KPI is to deliver the exact number of customers that remain loyal at the end of a determined period, excluding newly acquired customers in that period. Having this in mind, the numbers you have to collect to be able to measure CRR are:

- Active customers at the start of the given period

- Active customers at the end of the given period

- Newly acquired customers in the given period

Once you collect these pieces of information, the process is pretty simple. All you have to do is:

- subtract the number of newly acquired customers from the number of active customers at the end of the period

- divide the obtained value by the number of active customers at the start of the period

- multiply the obtained value by 100 to get the percentage that represents your CRR.

Customer Retention Rate Formula:

How to Improve Customer Retention Rate?

Some of the frequent tips for Customer Retention Rate improvement (that are popular for a reason) are the following ones:

1. Outperform and over-deliver.

In other words, promise less than you’re capable of doing and surprise them when they least expect it.

2. Keep the customers in the loop.

Notify them of the upcoming payments, important events, potential problems, and other relevant aspects before they occur. This way, you’re preventing their frustration, which may appear because of the circumstances they haven’t been informed about.

3. Improve your customer service.

Improve customer service by providing easily accessible support channels, well-trained and professional support staff, a 24/7 support system, etc.

4. Make a connection with your customers on social media.

This is a great way of sharing your brand’s vision in a more friendly and relaxed way. At the same time, you also get the chance of transforming your brand into an engaging virtual personality that will make your customers pay more attention to your brand.

5. Collect your customers’ feedback on their experience and satisfaction, and especially on their suggestions on your business improvement.

Take these comments into consideration when creating your business strategy for the periods to come.

#10: Customer Retention Cost

Just like Customer Acquisition Cost, Customer Retention Cost represents a valuable metric for the calculation of the Return On Investment (ROI). They both analyze ROI from the perspective of the efforts you have to invest in consumer monetization. So, if you include this parameter in your list of customer success metrics, you’ll be able to analyze how much it costs you to keep your current customers purchasing.

How to Measure Customer Retention Cost?

While it is pretty useful to keep track of this metric as it directly impacts your Customers’ Lifetime Value (LTV), it’s somewhat difficult to calculate it as there is no generally accepted formula.

Simply put, the essence of this metric includes analyzing different retention figures, for instance, total purchases after excluding acquisition costs, churn, retention costs, etc. And it’s good to keep track of these metrics having in mind that high retention costs decrease your profits as each following purchase actually has a lower overall worth.

Finally, what matters the most is having your average retention costs lower than average acquisition costs.

How to Improve Customer Retention Cost?

There are some pretty efficient strategies that can help you decrease retention cost while at the same time increasing retention itself.

- Instead of having a large number of representatives that aren’t well trained and move customers among themselves frequently, invest in hiring a smaller number of people who will be skilled enough to deal with the most of the issues customers may have. This way, you’re eliminating one of the common reasons for losing customers and investing your money more wisely.

- Make your website more informative and customer-oriented. Don’t make them depend exclusively on your customer support. Instead of investing all your money in a live support system, create a public knowledge base that will help them try to fix the problems on their own. Not only is it cheaper, but it can also be the source of customers’ loyalty as you increase your reliability and their independence.

- Don’t overpromise. Before you promise something to your customers, make sure that you really can handle it, and by handling it, we mean doing it without causing extremely high costs for your business. They will appreciate that you’re realistic, and you will keep your retention costs at a reasonable level.

Read More: How to Build a Customer Retention Strategy

#11: Customer Health Score

Customer Health Score (CHS) helps you figure out how likely your customer is to leave your brand or spread the word about it. Analyzing this metric, you can realize which customers you should focus on to reduce their frustrations and provide a satisfying experience for them.

How to Measure Customer Health Score?

This metric is another of those customer success KPIs that depend on your business nature. Different businesses, especially if they come from different industries, will measure CHS in different ways. However, there are two tips that you should consider when creating your ideal set of customer health metrics:

- Define the characteristics of a successful/unsuccessful customer in your business.

- Define the priority metrics that help you understand customers’ health. Some SaaS customer success metrics can be your customers’ frequency of logging in, their use of sticky features, the number of integrations, referrals, etc.

Once you’ve established the essential metrics, all you have to do is keep track of them in the way that suits your business needs. Probably the most efficient way of handling these diverse metrics is by using a well-developed customer relationship management software.

How to Improve Customer Health Score?

To be able to improve your CHS, pay attention to the critical parameters. Talk about the issues that your customers experience, or monitor their behavior on your website looking for red flags. Then, think of ways of overcoming those potentially problematic situations. What matters the most in the process of CHS improvement is your ability to understand their preferences and frustrations and quantify them using the right parameters.

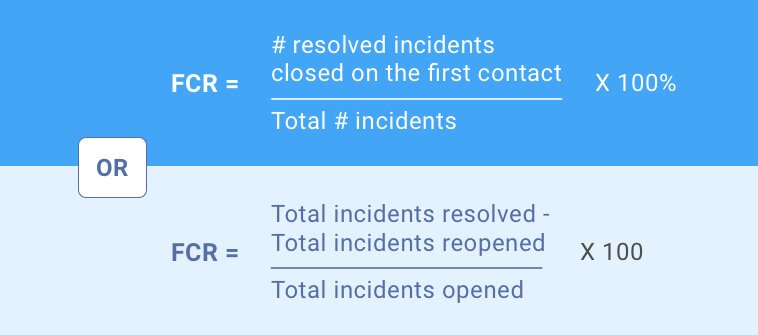

#12: First Contact Resolution Rate

First Contact Resolution Rate (FCR) is also frequently referred to as One-Touch Resolution Rate and First Call Resolution Rate. It is the customer success metric that shows how many of your customers’ inquiries are successfully resolved during their first interaction with your support. It can refer to your first live chat session, phone call, or an email resolved with only one reply, and it is expressed as a percentage.

How to Measure First Contact Resolution Rate?

This metric is not difficult to keep track of, and companies usually choose one of the following three ways:

- Directly surveying their customers after resolving the problematic situation;

- Monitoring the number of tickets successfully handled within a single interaction;

- Dividing the number of requests resolved in a single interaction by the total number of requests.

First Contact Resolution Rate Formula:

How to Improve First Contact Resolution Rate?

Having in mind that you should assess practically every factor that impacts your customer experience to find those that lower your FCR, you can improve this parameter in different ways:

- Analyze the issues that appear in repeat contacts, identify the areas which the issues belong to, and try to deal with the initial causes of those issues.

- Share a public knowledge base with customers to make it possible for them to access helpful information on their own, to prevent repeat sessions.

- Instead of making your support representatives stick to strict scripts, give them training and knowledge that will empower them to use their skills and intuition to provide adequate help from the start.

- Develop a fast and reliable ticket-routing system that will make it possible for the department in charge to resolve the problem efficiently during the first interaction. Avoid making the tickets wander from one department to another as this will negatively impact your FCR.

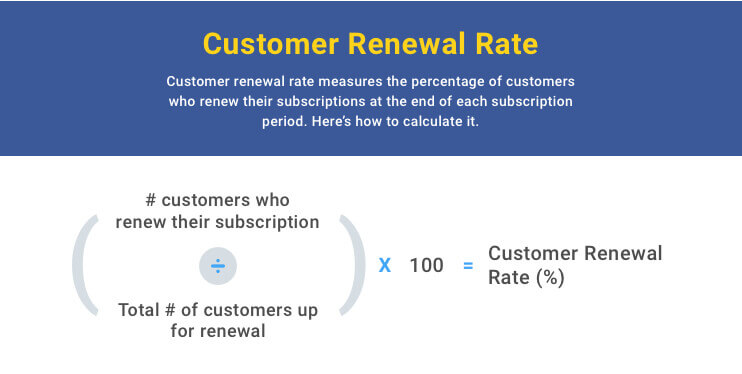

#13: Renewal Rate

To monitor Renewal Rate in SaaS companies usually means to stay on top of the percentage of customers who renew their subscriptions. However, depending on the company or industry, it can also refer to the recurring revenue and other values as well. The higher the value of this rate is, the higher is the value that your business provides to your customers, as they choose to stay loyal to you from one period to another.

How to Measure Renewal Rate?

Renewal Rate is probably among the SaaS customer success metrics that are the easiest to calculate. The only thing you should do before the calculation is to decide:

- on what period you want to base your calculation (days, week, months, years),

- for which category you want to measure it (customers, revenue, MRR).

Once you make these decisions, the calculation process is pretty simple.

If you want to calculate your Customer Renewal Rate, all you have to do is divide the number of customers that renew their subscriptions at the end of the chosen period by the number of customers who were up for renewal. Then turn this value into an exact rate by multiplying it by 100.

Customer Renewal Rate Formula:

To get to know Revenue Renewal Rate, divide the renewed revenue obtained in a certain period by total revenue up for renewal. Turn it into a percentage to calculate the rate.

Finally, to measure MRR Renewal Rate, you have to choose do you want to include or exclude the expansion.

In the case of excluded expansion, you’re calculating Gross MRR Renewal Rate by dividing renewed MRR by renewable MRR and multiplying the value obtained by 100 to turn it into a percentage.

If you want to include expansion, you’re measuring Net MRR Renewal Rate by dividing the sum of renewed MRR and expansion by the renewable MRR. Then it’s multiplied by 100 to show the percentage.

How to Improve Renewal Rate?

To be able to take your Renewal Rate to a higher level, you should:

- Offer the product that efficiently addresses customers’ issues and keep improving its main features. Creating real value for customers will undoubtedly make them increase the renewal rate.

- Invest your time and money in the improvement of your customer success, as this will positively impact a diversity of factors affecting your renewal rate, such as churn rate, expansion revenue, etc.

- Get into your customers’ shoes. Go beyond their buyer persona and try to think about their needs, preferences, and readiness to pay. Then approach them in the way that will make them want to renew their subscriptions.

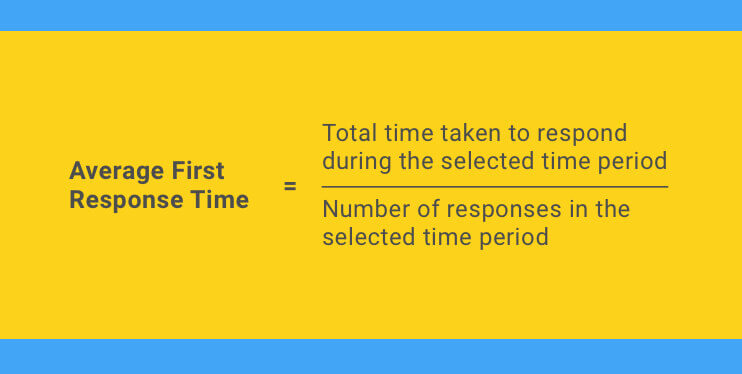

#14: First Response Time

First Response Time (FRT), also known as First Reply Time, represents the time it takes you to get in touch with your customers after they’ve initiated a live chat session or submitted a support ticket. Practically speaking, it’s the time your customers spend waiting for you to address their inquiries.

This parameter is especially important as it’s one of the essential factors of your general customer experience. If you make them wait too long, you’re decreasing your chances of keeping them satisfied right from the start.

How to Measure First Response Time?

The calculation is pretty simple. All you have to do is subtract the time of customer request from the time of your initial reply.

If you want to take this metric to a higher, more meaningful level, you can also keep track of the Average First Response Time. This is done by dividing the sum of First Response Time by the number of support tickets that you have successfully resolved.

First Response Time Formula:

How to Improve First Response Time?

Luckily, there is a diversity of ways that can help you decrease your First Response Time. Some of the most popular and reliable ones are:

- Training your support representatives that lag behind their colleagues in terms of reply speed.

- Introducing new, more efficient communication channels: live chat support tools, social media messaging, additional phone lines, etc.

- Improving the shift organization. If you happen to receive a major number of inquiries during non-working hours, holidays, or weekends, then try to have at least some of your employees working at these periods.

Read More: How to Reduce Customer Service Response Times

#15: Daily Product Usage

According to numerous experts, this customer success metric is one of the most overlooked ones. And it shouldn’t be, as the Daily Product Usage (also known as Daily Active User) lets you know how much your customers really need your product or service on a daily basis. It also enables you to obtain the number of customers that use your product far above or below the average.

How to Measure Daily Product Usage?

Depending on your business nature, you may want to measure DPU on a daily, weekly, or monthly basis. Nowadays, this is usually done using a reliable software solution, and there are numerous options in the market that provide a diversity of instruments, analytics, and customizable reports for both measuring and improving your DPU.

How to Improve Daily Product Usage?

Simply put, the improvement of DPU heavily relies on the convenience and features that a product offers. So, the most natural way of improving this parameter is by continuously upgrading your product or service by introducing new perks and advanced options that your customers will want to use every day.

Summing Up: Make Sure To Use Customer Success Metrics Properly

As you can see, there are a large number of SaaS customer success metrics that can help you stay on top of your relationship with customers.

If you’re willing to take your customer satisfaction and business performance to a higher level, in the first place, you should decide which of these metrics may be useful for your business. And this decision primarily depends on its industry, size, and growth goals.

Once you’ve made your perfect selection of metrics to measure customer success, make sure to keep monitoring them continuously, to be able to obtain realistic data, and compare the metrics values for different periods.

Finally, what matters the most in the process of metrics calculation is to keep your feet on the ground. So, if you want to improve your metrics’ performance, stay realistic, objective, and include all the relevant data when calculating them. Don’t camouflage the critical areas. Don’t ignore the red flags. The problems that you don’t start addressing as soon as they appear may cost you not only your customers’ loyalty but also your overall business reputation.

Now that we know the 15 most important metrics that help you measure customer success, it is time to answer a few frequently asked questions around them.

How can customer success teams measure operator performance?

This depends on the kind of tool you have in place. But some of the common metrics for you to monitor are customer feedback for individual operators, average rating, chat transcripts, customer engagement, customer retention, customer satisfaction score, and conversion rate optimization.

What types of metrics measure customer satisfaction?

There are in total five metrics that can help you measure customer satisfaction effectively. These five metrics include Net Promoter Score (NPS), Customer Acquisition Cost, Churn Rate, Customer Satisfaction Score, and Customer Effort Score. With these, you can easily measure how satisfied your customers are and where your services lack.

How to track customer success?

There are technically 10 ways through which you can track customer success. You can track factors like portfolio growth, MRR retention rate, referrals, account retention rate, less number of support tickets, product adoption increment, faster product onboarding, improved customer health mix, total number of monthly onboarding, and how many customers are still using your products.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!